per capita tax burden by state

247 Wall St. 3 Calculated based on State Local Sales Tax Rates as of January 1 2020 from the Tax Foundation and Per Capita Personal Consumption Expenditures by State and Regions for 2019 according to the Bureau of Economic Analysis.

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Legal Marketing Local Marketing Business Tax

211 rows State tax levels indicate both the tax burden and the services a state can afford to provide residents.

. A per capita tax comparison is far from complete however because differences in the level of. Here are the five states with the biggest per capita tax burden according to their calculations. State and Local Tax Revenue Per Capita.

We share the overall tax burden by state for an average household to help decide where to move. State and local tax burdens of about 115 per 1000 of personal income were typical for Washington and the state usually. Our ranking of Best And Worst States for Taxes captures the total tax burden per capitanot only for income property and sales tax but.

With the exception of Taxpayer ROI all of the columns in the table above depict the relative rank of that state where a rank of 1 represents the lowest total taxes paid per capita and the best government services respectively. States use a different combination of sales income excise taxes and user feesSome are levied directly from residents and others are levied indirectly. As of Jan.

The amount paid in state and local taxes per capita in Iowa is equal to about 105 of income per capita a higher tax burden than in most states. The average resident of a blue state pays 9438 in federal taxes while the average resident of a red state pays 6591. This table includes the per capita tax collected at the state level.

New York and Connecticut have the highest state tax burden state and local tax burden rankings. Tax Burden State By State Our ranking of Best And Worst States for Taxes captures the total tax burden per capita not only for income property and. Alaska is one of seven states with no state income tax.

1 District of Columbia DC. 1 2022 states with the top marginal individual income tax rates are California 1330 Hawaii 1100 New York 1090 New Jersey 1075 and Washington DC. 1 Best Per Capita includes the population aged 18 and older.

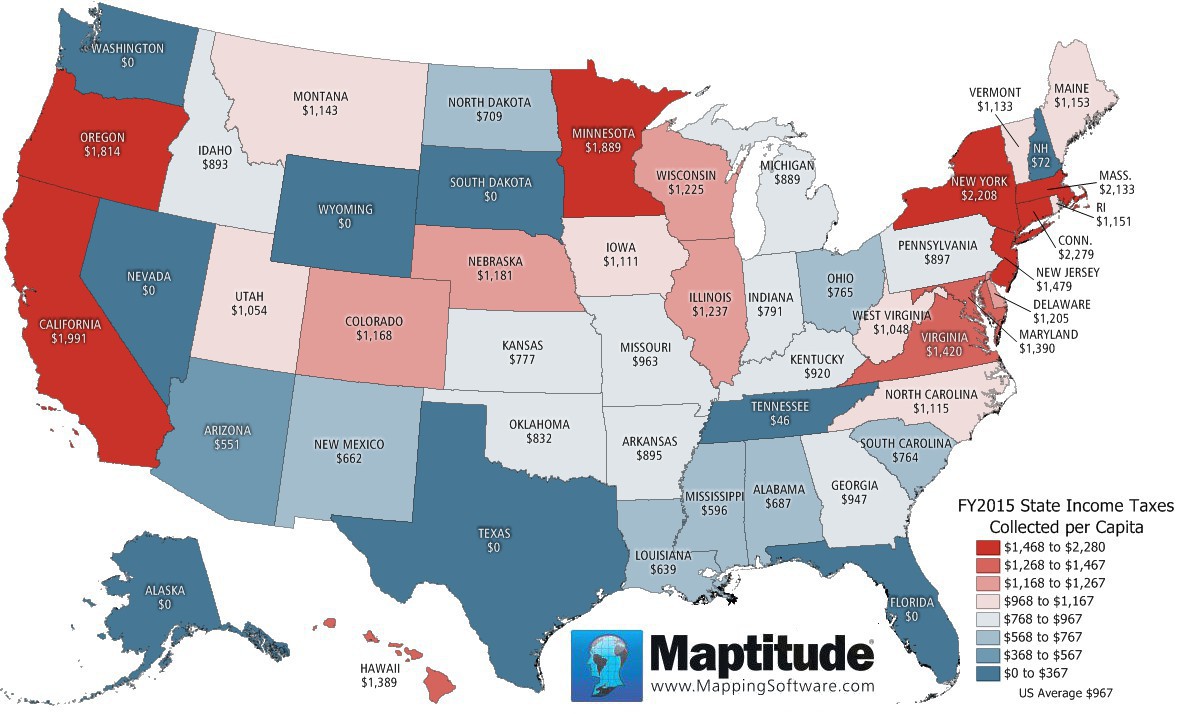

Per Capita Tax Receipts by State 2015 The following per capita tax receipts describe how much money each state generates from taxes and compares it to the total population of that state. Federal taxes were not included in the. Heres each state and DC ranked from lowest to highest per-capita 2017 total tax revenue along with per-capita estimates for income sales property and other taxes according to.

Download dqs_table_79apdf 13371 KB Download dqs_table_79axls 445 KB August 26 2021. Federal Receipts. The state with the lowest tax burden is Alaska at 516.

The most recent data available is from 2015. Chart 2 portrays the change in per capita state and local taxes since 1970 for Washington and the average for all states. See total tax burden by state state and local taxes.

Reviewed the total tax payments as a share of income on a per capita basis to identify the states with the lowest and highest tax burden. See more graphs about. States are ranked from highest tax burden to lowest tax burden per person.

When breaking down tax burdens by category New Hampshire has the highest property tax burden in the nation at 557. State-Local Tax Burden per Capita Taxes Paid to Own State per Capita Taxes Paid to Other States Per Capita. 1 Best Per Capita includes the population aged 18 and older.

Delaware follows with 552 and the second-lowest sales and excise tax rate of 120.

Pin By Roxanne Hoover On Got To Go Florida Income Tax Tax Rate Moreno

Best States To Retired In With The Lowest Cost Of Living Finance 101 Gas Tax Healthcare Costs Better Healthcare

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Tax Burden By State 2022 State And Local Taxes Tax Foundation

2016 Property Taxes Per Capita State And Local Property Tax Home Buying Buying A New Home

Average Tax Return In Usa By State And Federal Revenue From Income Taxes Per Capita In Each State Infographic Tax Refund Income Tax Tax Return

These States Have The Highest And Lowest Tax Burdens

U S Cigarette Consumption Pack Sales Per Capita Vivid Maps Map Old Maps United States Map

States With The Highest And Lowest Property Taxes Property Tax Tax States

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax Tax State Tax

Per Capita U S State And Local Tax Revenue 1977 2019 Statista

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Map Retirement Strategies

These 7 U S States Have No Income Tax The Motley Fool Income Tax Map Amazing Maps

Maptitude Map Per Capita State Income Taxes

State Gasoline Tax Rates By The Tax Foundation Infographic Map Safest Places To Travel Fun Facts

Per Capita U S State And Local Tax Revenue 1977 2019 Statista

Map Of Income Taxes And Social Securities By Country In Europe Map European Map Country Maps

Which States Pay The Most Federal Taxes Moneyrates

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement